Did you know?

Nearly half of all households in the United States experienced at least some loss of employment income since March 2020. Access to affordable, reliable energy is one thing that can make a difference for the American families and businesses trying to recover from the last year. But recently there have been a number of proposals that would tax us and our energy—driving up costs, driving down wages and hobbling our most affordable energy sources:

- The Biden Administration has said it may support a carbon tax. A carbon tax of $40 per ton would add approximately 36 cents to the price of a gallon of gasoline—adding almost 13% to the price of a gallon of gas—or approximately 2 cents to the price of a kilowatt-hour of electricity, harming low-income households the most.

- They have even suggested taxing Americans on the number of miles they drive. A mileage tax would hit low-income earners—who spend a higher percentage of their income on energy costs—the hardest. And the tax would disproportionately affect rural and urban communities where distances for services and commutes for workers are often much longer than average.

- Biden wants to finance his “carbon pollution-free” electrical grid with tax subsidy handouts for “green” energy. In an attempt to get to his carbon-free power grid goals, Biden calls for a number of tax credits for so-called “clean energy,” while instituting policies that would harm traditional energy sources and drive up costs to consumers.

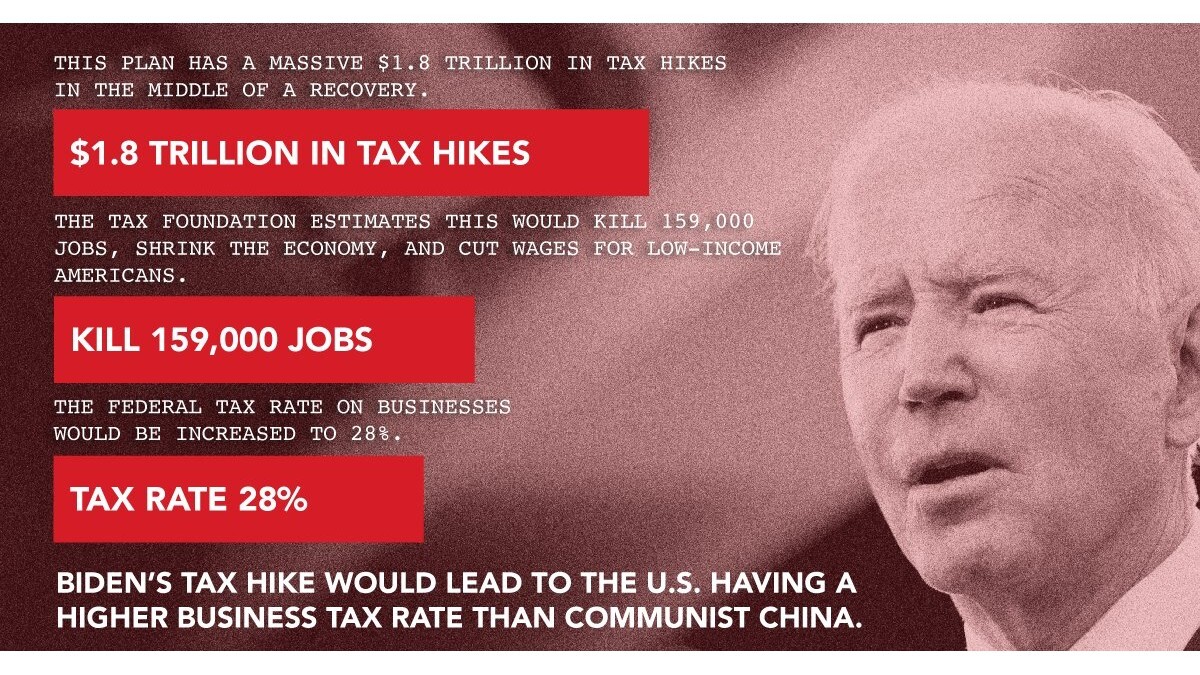

- Meanwhile, he wants to hike taxes on the rest of us. His corporate tax hike puts the burden on workers, consumers and investors—not corporations. Biden’s proposal to hike the corporate tax rate will just add another layer of costs—on energy and almost everything else. Studies have shown that corporate tax hikes are inevitably passed on to consumers in the form of higher prices and workers in the form of lower wages.